Are you constantly worrying about your bad credit history affecting your ability to get insurance? You’re not alone. Many individuals face this challenge. Fortunately, there’s a solution: no credit check insurance. In this comprehensive guide, we’ll delve into what no credit check car insurance is, how it works, its benefits, and why it might be the perfect fit for you.

- What is No Credit Check Insurance?

- Understanding the Need for No Credit Check Insurance

- How No Credit Check Insurance Works

- Benefits of No Credit Check Car Insurance

- Who Should Consider No Credit Check Car Insurance?

- Comparing No Credit Check Insurance vs. Traditional Insurance

- Insurance Bad with Bad Credit: Overcoming the Stigma

- Breaking Down the Stigma

- Empowering Individuals with Options

- Summary

- Auto insurance companies that don’t require credit scores

What is No Credit Check Insurance?

No credit check insurance is exactly what it sounds like: insurance policies that don’t require a credit check during the application process. This type of insurance is particularly beneficial for individuals with bad credit or those who prefer not to have their credit history affect their insurance rates.

Understanding the Need for No Credit Check Insurance

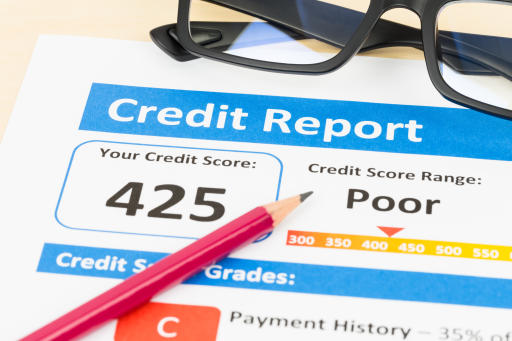

Many people find themselves in a predicament where their credit score doesn’t reflect their ability to be responsible insurance policyholders. Whether due to past financial hardships or other circumstances, having bad credit shouldn’t necessarily equate to higher insurance premiums. However no credit check insurance addresses this issue by assessing risk factors beyond credit scores.

How No Credit Check Insurance Works

Traditional insurance companies often use credit scores as one of the factors in determining premiums. However, with no credit check car insurance, the focus shifts to other aspects, such as driving record, age, location, and type of coverage required. Additionally this allows individuals with bad credit to obtain insurance at rates that are more reflective of their actual risk.

Benefits of No Credit Check Car Insurance

One of the primary benefits of no credit check car insurance is accessibility. It opens up opportunities for individuals who may have been denied coverage or faced exorbitant premiums due to their credit history. Additionally, it provides peace of mind, knowing that your credit score won’t hinder your ability to protect yourself and your assets.

Who Should Consider No Credit Check Car Insurance?

If you have a less-than-perfect credit score or have experienced financial difficulties in the past, no credit check car insurance could be an excellent option for you. Whether you need auto insurance, home insurance, or another type of coverage, exploring this option can potentially save you money and hassle in the long run.

Comparing No Credit Check Insurance vs. Traditional Insurance

It’s essential to weigh the pros and cons of both options before making a decision. While no credit check insurance offers accessibility and flexibility, traditional insurance may have additional perks or discounts that could benefit you. Consider your individual needs and circumstances when comparing the two.

Insurance Bad with Bad Credit: Overcoming the Stigma

Additionally, let’s discuss the stigma associated with obtaining insurance with bad credit.

Breaking Down the Stigma

Unfortunately, there’s often a stigma attached to having bad credit, which can extend to various aspects of life, that for example include insurance. Some individuals may feel embarrassed or judged when seeking insurance with bad credit. However, it’s essential to remember that everyone faces financial challenges at some point, and there are solutions available.

Empowering Individuals with Options

However no credit check insurance empowers individuals with bad credit by providing them with viable insurance options. Therefore By removing the barrier of credit checks, individuals can focus on finding the right coverage for their needs without worrying about their credit history holding them back.

Summary

In conclusion, no credit check insurance offers a practical solution for individuals with bad credit who need insurance coverage. Consequentially By eliminating credit checks from the equation, it provides accessibility, affordability, and peace of mind. Whether you’re in need of auto insurance, home insurance, or another type of coverage, exploring the option of no credit check insurance could be the key to securing the protection you need without the added stress of your credit score.

Remember, everyone deserves the opportunity to protect themselves and their assets, regardless of their credit history. So, if you’ve been hesitant to explore insurance options due to bad credit, don’t let that hold you back any longer. Take control of your financial future and explore the possibilities of no credit check insurance today.

Auto insurance companies that don’t require credit scores

If your score falls into the fair or poor range (under 670) and you’re worried you won’t be approved for car insurance — or if you’ve already been denied — then you might turn to companies that do not use your credit report data to approve your insurance application.

CURE

This auto insurance company was founded on the premise that everyone deserves to pay a fair rate for insurance, regardless of their salary, education level, and credit score. Cure does not use credit or insurance scores in its application processes, making it easier for drivers with bad credit to get approved.

On the downside, CURE auto insurance is only available in a handful of states — New Jersey, Pennsylvania, and Michigan.

You can learn more at https://www.cure.com.

Dillo

Dillo is another car insurance provider who does not use credit scores or even accident history to make insurance approval decisions. This provider also does not charge more if you have a lower credit score or ticket and accident history.

Unfortunately, Dillo is only available in Texas, limiting the number of applicants able to apply for this coverage.

You can learn more at http://www.dillo.com.

[…] Insurance with Bad Credit: Breaking the Stigma […]

[…] What is No Credit Check Insurance? […]

[…] Insurance with Bad Credit: Breaking the Stigma […]

qDFmNYuSpZH